The AI-Bubble - Slow hiss or big bang?

I was an early adopter to the thesis that we are in an AI bubble destined to burst. When you look around, the symptoms are textbook: the hype cycle is deafening, valuations are divorced from reality, and the FOMO driving capital allocation is palpable. It is no surprise that comparisons to the Dot-com crash of 2000 or the Subprime Mortgage crisis of 2008 are being thrown around with reckless abandon.

However, I also know that history rhymes but not obviously repeats itself exactly.

While the structural similarities to previous crashes are undeniable, the differences in this cycle are arguably just as significant. When we look past the headlines and examine the actual mechanics of the current market, the evidence starts to points less toward a catastrophic explosion and more toward a controlled deflation. We may well be looking at a slow hiss rather than a big bang.

Here are some critical factors pushing me to think that the AI market is heading for a turbulent correction, but not necessarily a systemic crash.

The canaries in the AI-coalmine are singing loudly

In 2000 and 2008, the prevailing sentiment was irrational exuberance until the very last second. Sceptics were few and far between, and they were largely ignored or ridiculed until the floor fell out (in fact, I was a sceptic in 2000 and that saved me a lot of money). In 2008, the complexity of the financial instruments hid the rot from almost everyone. In 2000, companies with zero revenue were treated like blue-chip stocks by the majority.

Today, the landscape is different. The "AI coalmine" is full of canaries, and they are making a lot of noise. And we have social media algorithm that loves to amplify negative opinions.

We are now seeing prominent analysts, venture capitalists, and even tech leaders openly questioning the Return on Investment (ROI) of Generative AI. We are having serious discussions about hallucination rates, copyright infringement, and the commoditization of LLMs. Scepticism is now baked into the conversation, investors and enterprises are becoming more cautious.

When everyone is looking for the bubble to burst, they tend to hedge their bets. This heightened awareness prevents the kind of blind, unmitigated leverage that turns a market correction into a systemic collapse. We aren’t walking off a cliff blindfolded this time, we are staring right at the edge.

Physical Constraints as a Safety Valve

Perhaps the most overlooked difference between this cycle and the software-based bubble of 2000 is the physical reality of Artificial Intelligence.

The Dot-com era was defined by software and websites—assets that could be replicated infinitely with low marginal cost. Capital could flow in instantly, and "vaporware" companies could scale their promises overnight.

AI, by contrast, is shockingly physical. The hundreds of billions of dollars in announced investments are largely earmarked for physical infrastructure: datacenters, GPUs, and specialized cooling systems. But you cannot simply code a datacenter into existence.

We are currently hitting hard logistic walls:

- Power Shortages: The grid cannot support the gigawatt-scale demands of proposed clusters in many regions.

- Cooling Limitations: Advanced chips require advanced cooling, which requires water and infrastructure that isn't readily available.

- Regulatory Pushback: Local governments and communities are increasingly refusing permits for new datacenter due to environmental concerns and resource drains.

Paradoxically, these bottlenecks are a good thing for market stability. They act as a governor on the engine. Even if investors wanted to pour unlimited money into the sector immediately, the logistics won't allow it. Investments are being forced to slow down to the speed of construction and power generation.

This physical friction prevents the capital floodgates from opening too wide, too fast. It forces a staggered deployment of capital, which naturally smooths out the investment curve and reduces the risk of a sudden, violent capital flight.

A controlled descent or a delayed crisis?

So, will we see a soft landing? It is maybe a plausible scenario, but we cannot ignore the sheer weight of the risk currently sitting in some balance sheets.

While the physical constraints and early scepticism provide a buffer, they do not neutralize the danger. There is a massive amount of debt and speculative capital currently tied up in hardware and infrastructure that has yet to generate a dollar of profit.

Regardless of whether the bubble pops or hisses, one outcome is virtually guaranteed: casualties. We will see a wave of startups going to zero and a series of bankruptcies as the market tightens. The ecosystem simply cannot support this many players chasing the same limited revenue pools.

We might not face a sudden, surprise shock like 2008, but we could be looking at a prolonged period of painful market digestion. As the hype bleeds out, constrained by mathematics and caution, the market will have to reconcile high valuations with actual utility. The crash might not be sudden, but for those holding the bag on over-leveraged infrastructure, a slow deflation can be just as destructive as a burst.

The AI revolution is real, but the bridge to get there is actually built on too heavy debt and heavy expectations. Whether that bridge holds or slowly buckles remains a trillion-dollar question.

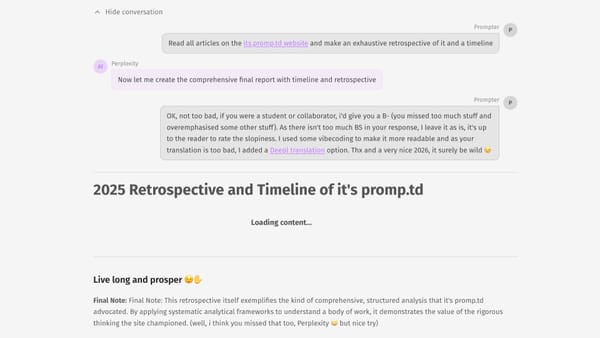

Live long and prosper 😉🖖